Understanding construction in progress accounting is essential for construction professionals, including project managers, accountants, and financial executives. Construction in progress accounting involves keeping a detailed record of all expenses incurred while constructing a long-term asset. These expenses are reported under the “property, plant, and equipment” section of the balance sheet. Assets under construction are those not yet ready for use, potentially among the largest fixed assets a company holds.

Meeting Financial Reporting Requirements

This is a methodology focused on constantly evaluating and improving project processes, outcomes, and https://www.instagram.com/bookstime_inc team performance. The other side of the transaction will impact the cash or accounts payable balance. It will depend on the nature of purchase that which company has with the suppliers. Drones – Aerial footage feeds video recognition systems to track progress and expenditures based on items completed or materials delivered.

Construction in Progress Accounting: What You Need To Know

- Revenue and costs related to unfinished goods are accrued based on the percentage of completion estimates.

- Accountants do not begin tracking depreciation of construction-in-progress assets until the addition is complete and in service.

- Getting CIP accounting right is a continuous process of assessing gaps, implementing improvements, and maturing standards across construction projects.

- One effective method for tracking these costs is through the use of specialized construction accounting software.

- It involves capturing all expenditures related to materials, labor, equipment, contractors, and other elements required for constructing the asset.

- By taking all of these factors into consideration, it is possible to develop a clear picture of the true cost of a contract and ensure that it represents good value for money.

- The cost-to-cost method compares the costs incurred to date with the total estimated costs, while the units-of-delivery method is based on the number of units delivered or installed.

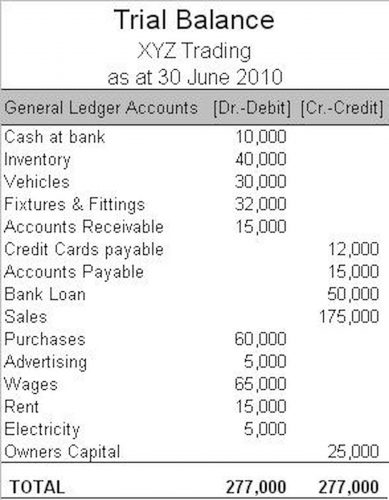

However, as the company expands, recruits more employees, and works simultaneously on multiple projects, tracking transactions on a spreadsheet gets difficult and time-consuming. To minimize discrepancies and keep records clean, construction companies usually opt for double-entry accounting, in which entries are added twice to a ledger to record a single transaction. It is the approved bookkeeping method in the construction industry, viewing the complexities involved.

- This involves identifying the scope of work, analyzing project requirements, and determining the financial resources needed to complete the project successfully.

- Construction-in-Progress (CIP) accounting plays a vital role in ensuring that costs are accurately tracked and financial statements reflect the true state of ongoing projects.

- This approach is based on the premise that if the outcome of a contract can be estimated reliably, then it is possible to allocate revenue and costs according to the work that has been completed.

- The basis for the effort expended can be labor hours, the material used, or machine hours.

- The construction in progress can be the largest fixed asset account due to the possibility of time it can stay open.

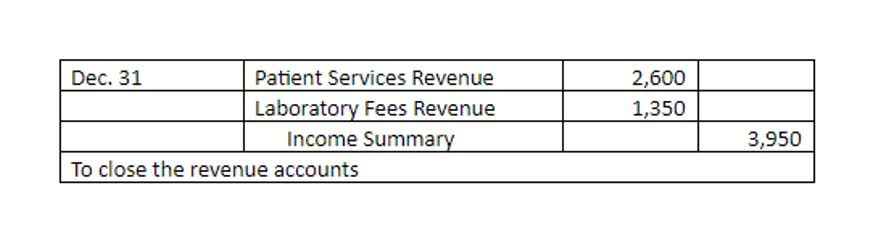

Construction in Progress Journal Entry

2) On March 22, 2021, Business A used some of its materials valued at $2,000 to construct the expansion. 1) On March 11, 2021, Business A received a $100,000 bill from Builder’s Warehouse for construction materials.

Fostering Financial Transparency with CIP Accounts

We provide a range of services including fractional CFO, bookkeeping, https://www.bookstime.com/ accounting, and financial strategy. Each service is designed to meet the unique needs of scaling startups across various industries. Our goal is to empower businesses with the financial insights they need to thrive.

What is the accounting entry for construction in progress?

A CFO, or Chief Financial Officer, is a senior executive responsible for managing the financial actions of a company. This includes financial planning, risk management, record-keeping, and financial reporting. Essentially, a CFO plays a crucial role in guiding the financial strategy of a business. Therefore, construction firms must ensure integrity within their CIP accounting and reporting approach to enable sound financial management.

Construction in Progress Accounting Procedures and Protocols

Construction companies and contractors understand construction projects can span months or years before completion due to the scope of work. Between the start and end of a project, companies must maintain construction accounting records to track costs and revenues. It’s a method a construction company uses to record and report financial transactions and progress from beginning to end. It’s also crucial when a company needs to secure bank loans, demonstrate bond capacity, and receive audit and assurance services. It is crucial to understand the distinction between fixed assets accounting cip and construction in progress for accurate accounting and financial reporting.